How to top up Vk Pay and not overpay for transferring funds to an electronic wallet? Finding the most convenient method for depositing funds will not take much time from users, since the developers of the payment service have left account owners with virtually no options or room for maneuver. There is only 1 main method of replenishment, which can be considered from different angles and expanded to several similar options. This expansion of capabilities is due to the versatility of currently existing online wallets and financial systems. To understand what has been said, it is worth considering all the methods proposed by the developers a little more carefully.

What is VK Pay

We are talking about a method of paying for goods and services in VK and online stores. This is a special platform created by VKontakte developers for quick and convenient communication between users and businesses.

VK Pay is an analogue of an electronic wallet, with which you can make purchases without unnecessary manipulations. The closest analogue of this platform is the world's largest online payment system - PayPal. Main advantages of VK Pay:

- To use it, you just need to be authorized on VKontakte - no separate registration on the service is required.

- Make payments in a few clicks - without unnecessary details.

- VKontakte transfers by phone number or QR code.

- Cashback and a lot of profitable offers for users of the service.

- No fees for entering funds into the system, for making transfers, for withdrawing money to a card (in some cases).

The service is gaining momentum over time. Considering that the number of VK users is constantly growing, VK Pay has good prospects for development.

How to buy something?

Let's say you want to buy a Whopper at Burger King for 69.9 rubles. Then you need to go to the VK Pay application, select a product and click “Pay via VK Pay”. After this, you will receive a code via SMS, which you need to call at the checkout, and then wait a little while they make you a burger. When choosing other goods, you indicate the method of receipt (in the store or by courier delivery) and also pay the invoice in rubles via VK Pay.

If you want to receive money from someone, you can generate a QR code (the button is located in the upper left corner of the screen) and send a link to it to the person. By clicking on it, he will be able to transfer the required amount.

Find a card with cash back on all purchases

Debit card calculator

On what basis do the types of accounts differ in VK Pay?

Currently, the service provides two types of accounts - basic and advanced. The first type is available immediately after accepting the user agreement. The second type of account is awarded after passing the identification. Basic and advanced profiles differ in several respects. The basic account is used under the following conditions:

- Keeping no more than 15 thousand rubles in the account, and making payments in the amount of up to 40 thousand rubles.

- Withdrawing funds to a card from VK Pay is not available.

After passing the identification, the user is awarded an extended status. From this moment on, the following conditions are available to him:

- Storing up to 60 thousand rubles in the account, and making payments in the amount of up to 200 thousand rubles.

- Transfers to other users - up to 15 thousand rubles at a time, and up to 40 thousand rubles per month.

- Withdrawal to a bank card is available.

Identification is not required. This is a purely voluntary procedure. But after completing it, the user gains access to the expanded functionality of the service.

How to get extended status in VK Pay

Identification is a fairly simple procedure that is performed online. To do this you need to do the following:

- Log in to VK Pay and open the “Settings” section.

- Follow the link “Basic status”, and then “Improve account”.

- Provide your passport details and one additional document of your choice - TIN or SNILS.

Verification is carried out through the Unified identification and authentication system. User data authentication takes up to 24 hours. Based on the results of the check, the user receives a notification. The profile data in VK and the information specified during identification may not be interconnected in any way.

How to use VK Pay

VK Pay is a universal method of mutual settlements with stores, banks and individuals. In order to pay the account, you need to deposit money into the virtual account from a debit card. You can use the service using a PC or smartphone.

To ensure that the process of depositing and withdrawing money does not take much time, you need to fill out a form and activate your VK Pay account. After this, you can link the card to your wallet and make contactless payments. In fact, you can link several cards from different banks.

To replenish a virtual account, enter personal data and enter your personal account, then click “Top up”, fill in the data in the table and confirm the financial transaction, after which the money will be credited almost instantly. Payments are also made through the account and money is transferred to other users.

Is it necessary to link a bank card to VK Pay?

Linking a card is a voluntary procedure. The fact is that without a card (credit or debit) you will not be able to top up your balance on the service. You can also withdraw funds only to the card.

If there is not enough money in your account to make a purchase, you can pay for the cost of the goods from your card without entering its details. In total, up to 3 bank cards are linked to one profile.

There is no alternative option for replenishing your balance in VK Pay. Yandex.Money, QIWI, Webmoney and other systems are not used for these purposes. Replenishment is made only from bank cards.

Yandex money

Using the Yandex Money service is no different from the above approach. Users will have to create a virtual card on the Internet or order real “plastic” from the payment system. It is important to emphasize that you can transfer money from both a debit and a credit card. It is worth adding that after creating a virtual card and receiving the details you will have to:

- Log in to the social network and open the wallet tab;

- enter your PIN code;

- open a section with an offer to top up your wallet;

- indicate the desired replenishment amount;

- enter the details in the form provided;

- complete the operation by confirming the actions taken.

The only reason for refusing a transaction will be exceeding limits and violating the rules of financial platforms (Yandex and VK).

Depositing and withdrawing funds from VK Pay

The balance is replenished from Mastercard, Maestro, VISA, Mir bank cards - no commission. The exception is when the transaction fee is charged by the issuing bank. There is also no commission charged for transfers within the system.

You can withdraw money from VK Pay only to a bank card of one of the specified payment systems. Money is not withdrawn for alternative resources.

Money is withdrawn to Mastercard and Maestro cards free of charge, provided that the withdrawal amount does not exceed 15,000 rubles. If the limit is exceeded, or when withdrawing to cards of other payment systems, the commission will be 3%, but not less than 50 rubles.

What can you spend it on?

As you can see, transferring money to VK Pay is not at all difficult. On the contrary, the service is aimed at maximum user comfort. What can you spend your savings on? Yes to anything! You can even simply withdraw all the money from the system.

When you enter your account, you can see many offers at once.

Among them:

- Games.

- Books.

- Internet.

- Charity.

- Payment of fines.

- Purchasing air tickets.

- Clothing, gadget, food stores.

- And many many others.

In general, VK Pay gives you huge scope for online purchases. At the same time, you can transfer money to other users, pay in cafes and cinemas, and pay other bills. So, quickly top up your account and try all the delights of this payment system.

How does the VK Pay service differ from regular VKontakte transfers?

Registered users can link a bank card to their profile and transfer money from its account in a message to friends and acquaintances. The recipient can withdraw this amount to a personal card. The mechanism is similar to the one used in VK Pay.

There is one significant difference. It lies in the fact that in the first case we are talking about a direct transfer from card to card, which must be accepted by the recipient within 5 days.

VK Pay works on a different principle: here users first deposit funds from the card, then make all the necessary operations from their account. There is no translation lifespan. From the money credited to your balance in VK Pay, you can pay for goods in the affiliate network, or transfer them to another user.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Precautions on VKontakte

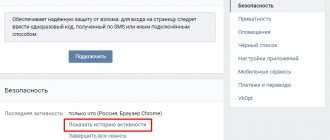

Of course, many are concerned about the question of whether it is safe to use the new service. Despite the fact that an additional PIN code is used to enter the VK Pay wallet, it is still worth taking additional precautions.

In particular, after each payment or transfer of money to the balance of your VKontakte account, it is better to delete the linked bank card from your page. Hacker attacks on users are not uncommon. And if attackers manage to hack the PIN code from VK Pai, there is a danger of not only losing money on the card, but also being left with a negative balance.

The VK Pay payment system is a convenient innovation, primarily for sellers and buyers of VKontakte goods. However, thanks to this innovation, users also have many other excellent opportunities to make financial transactions without overpaying commissions. However, we must not forget about restrictions on transfer amounts and the protection of your personal data on the social network.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Instructions for setting up VK Pai in the vkontakte store group

Once VK Pay is set up for your account page, your wallet can also be used to receive payment through the VKontakte communities you created. If you already have a group, your VK Pay account will be connected to it automatically. When you own a full-fledged online store on a social network with a showcase, a shopping cart, and established delivery methods, then to pay for goods you will have to additionally install a wallet in the settings.

How to top up vk pay from a card, phone, qiwi wallet

To do this, follow these instructions: Step 1. On your store page, open the menu of the “Actions” section. Here select the “Community Management” item.

Step 2: This will take the user to the group settings. Through the control panel, open the “Sections” page.

Step 3. Here about.

Step 4. A new form will appear that must be filled out correctly:

- here you need to set the currency “Russian ruble”;

- then tick the “Store” category;

- after that, open the “Main block” list and click on the “Products” item in it.

Now you can click on the “Save” button.

Step 5. Return to the main page of the store and click on the “Add product” button.

Step 6. Fill out the form for adding a product and click on the “Create” button.

Step 8. Here you assign a store administrator to whose account payments will be received. And click on the “Next” button.

Step 9. After this, check the order form.

Step 10. And set the quantity of goods. Then click on the “Go to application settings” button.

Step 11. Here, in the “Payment Type” category, select “VK Pay” and click on the “Save” button.

The appointed administrator must have a document of a citizen of the Russian Federation. Only in this case will he be able to accept payments to the VK Pay wallet.

Setting up a VKontakte e-wallet may seem like a complicated task. But in reality it is a very simple procedure. It only takes a few minutes. Although you will have to wait a day while social network employees check your identification documents. However, after this you will be able to use your account as a full-fledged electronic wallet for online payments.